MF VS PMS VS BENCHMARK RETURNS

Falconstar Investments

Apr 5, 2021·4 min read

"PMS vs Benchmarks vs MF" To be continued....

Dear Investors,

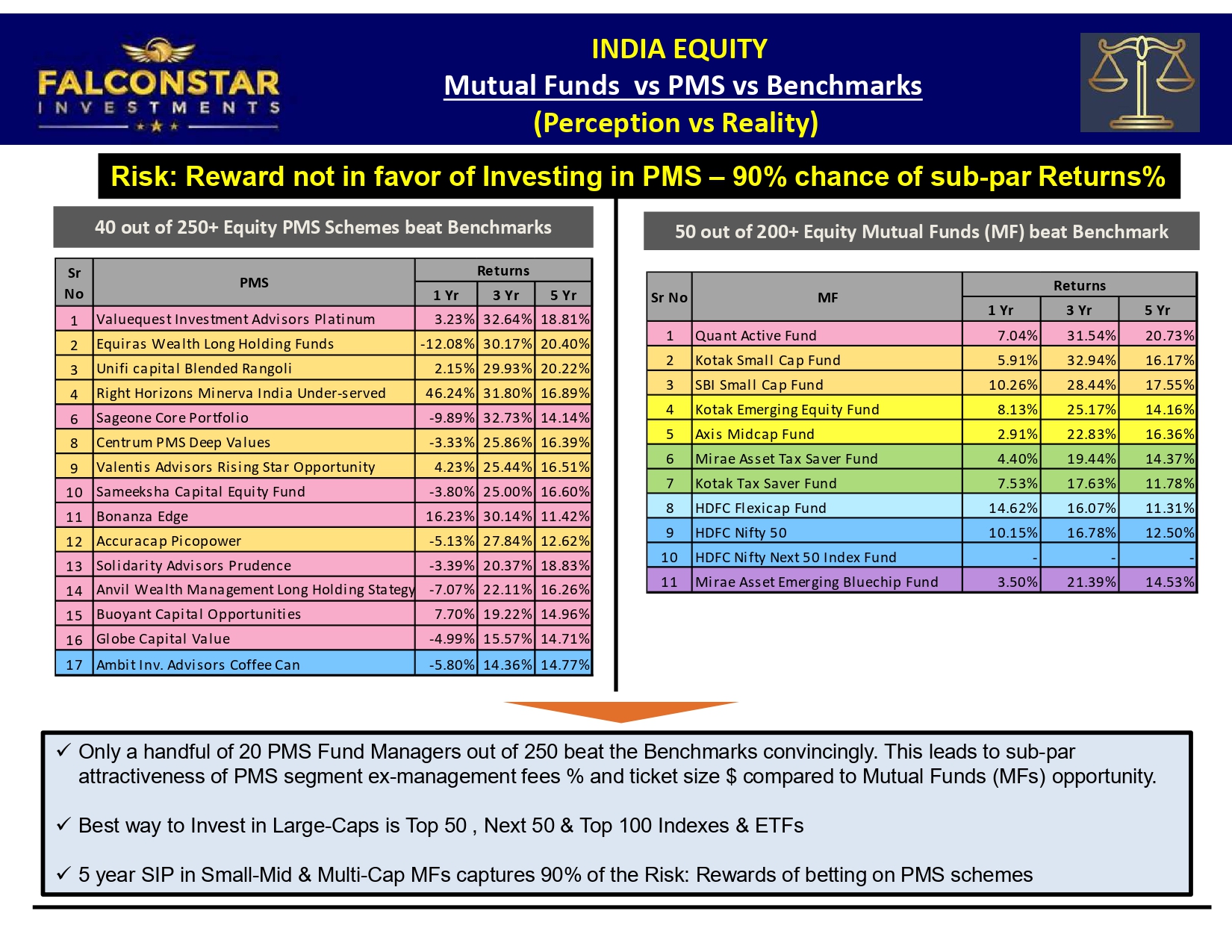

It is good to remain aware of fundamentals of perception vs reality in various Investment products like Mutual Funds / PMS schemes. The Data confirms that India Equity is not different from US & developed Markets where only Top Quartile (25%) Funds beat the Benchmarks.

Significant due diligence is required before choosing PMS as an Investment option for HNIs. There is 90% chance of sub-par returns in PMS based on relationship driven hasty decisions. Out of 250+ PMS schemes barely 20 Fund Managers are demonstrating the capability for superior stock picking compared to Benchmarks. The Data is even more dismal when we compare with comparable Mutual Fund (MF) managers because there are 40 MFs which also beat the Benchmarks.

Following conclusions can be drawn :

1) Mutual Funds (Indexes and ETFs) are best vehicles to ride the Large Cap (Top 100#) space

2) Small-Micap segment 5 year SIP in MFs is recommended based on empirical performance

3)20 PMS schemes can be considered by HNIs as part of their overall Asset Allocation % strategy

Look forward to continued dialogue with Falconstar Investments for your Investment goals and assuring you of best in class investment products & services.