Wealth Management

Wealth Management for NRIs & HNIs:

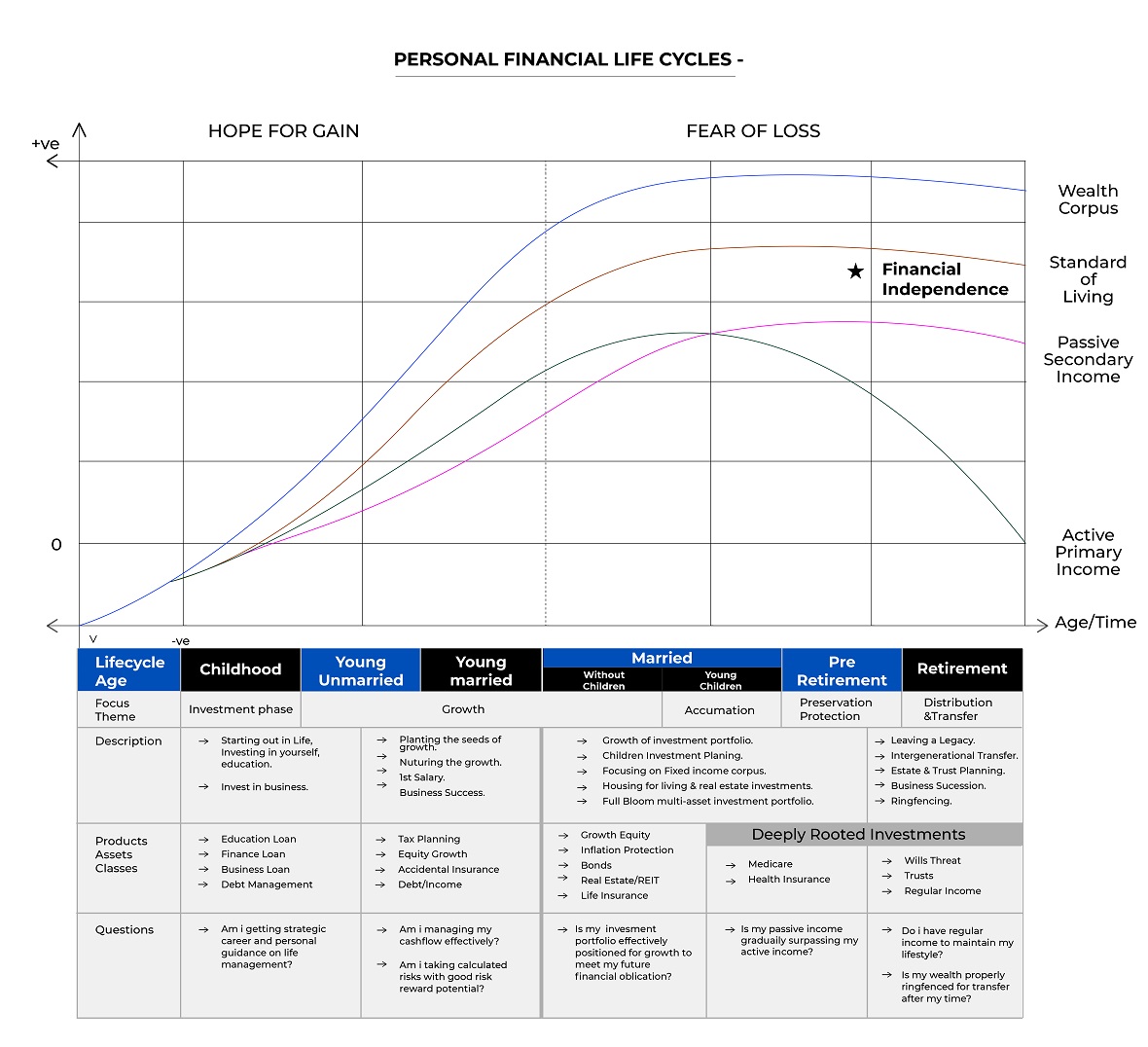

At Falconstar global wealth management we offer bespoke Investment solutions, services & products for unique client needs befitting every stage of their life and wealth cycle.

With a backdrop of Institutional framework, we believe that wealth management has to be customized to suit client profile and circumstances. Our products and services under the umbrella of wealth management cover all 4 major Asset classes:

-

Cash and Liquid Equivalents

-

Equities or Stocks

-

Fixed Income or Bonds

-

Alternative Investments

Unique Features and Capabilities of Falconstar Wealth Platform:

With decades of experience in Indian wealth management landscape, we have created a platform which is focused on practice of wealth creation for clients with efficient building blocks:

-

Integrated Client Centric Platform: Our business model is designed to cater to niche segment of NRI and HNI clients of Indian origin across geographies. Our operational efficiency is optimized through best in class technology backbone and centralized booking office.

-

Client Summary Reports: Concise MIS is key to give clients comfort and clarity on their portfolio performances and summary of holdings. We take extra effort to provide transparent, accurate and consistent client reports to give them comfort that their wealth is secure and efficiently deployed.

-

Expertise across Asset Classes: During different times of the macroeconomic and market cycles we witness different segments outperforming or providing value. Our depth and breadth of market research provides us the confidence to give expert investment advice based on optimum risk-reward scenarios and market beating performance.

Key Services

-

Financial Investment Game-plan

We want to give the clients the benefit of our decades of investment experience in finding the right financial solutions for their situations. We want to put our experience to work and provide the administrative capability to bolster the execution plan of achieving financial objectives for clients (individuals and institutions).

-

Child Financial Planning:

Investment planning for children’s financial future involves starting regular investments at an early age for the child going through school to higher education. In securing children's capital requirements for education, marriage and other important life events, it is critical to have regular inflow of investment returns to take care of periodic expenses during teen-age and a lump sum payout at maturity. We believe that children investment schemes are an important building block for planning a bright future for children. At any point of time, we have a database of internally approved and recommended child schemes for our clients.

-

Retirement Planning:

Investing towards achieving financial goals is about optimizing the time on hand and the initial investment corpus advantage. We believe that retirement planning should begin when one starts earning income. A regular contribution (anywhere from 10-40%) of the monthly income during age 20s and 30s if channelized towards an investment program can go a long way in providing the much needed financial comfort during 50s and retirement years.

There are several thumb rules for retirement investment planning to harness the power of compounding in one's favor as age progresses. Just for example, starting early with a 10% contribution from income at age 25 with a 75% Equity : 25% Fixed Income is better than starting with a 25% contribution from income at age of 40 with (100-Age) % equity allocation.

We help clients devise a thoughtful investment game-plan keeping in mind various moving parts of market and individual dynamics. The goal of retirement planning is to give financial security and comfort to clients that their financial needs after retirement will be safely met and that they can meet exigencies in form of unplanned health expenses at older age.

Insurance Protection Planning:

It is a fundamental form of planning to insure for untimely death, critical illness or disability. Although protection planning deals inherently with downside, unfortunate and unforeseen risks in one’s life, one can consider protection planning from the lens of asset protection, income protection, life protection or critical illness. In lot of ways, depending on various factors like life cycle or wealth cycle, protection planning can precede investment planning. Sometimes it is important not just to grow the wealth but also to protect the family with insurance.

We are committed to helping clients assesses their insurance needs and execute their insurance management program. Our goal is to provide clients with sound insurance planning in harmony with their needs and wants. With our rich personal and professional experience in Insurance products, we are dedicated to developing lasting relationships with our clients.

Our bespoke advisory helps in navigating complex insurance products and provides a roadmap for a well-managed insurance program.

Once the clients goals have been established, we customize appropriate strategies to suit their vision and objectives. We can help you execute a sound insurance program utilizing the bouquet of personal, home, automobile, property, general and retirement group products.

One of the prime benefits of working with us is our independent agency, non-biased viewpoint; ability to provide easily understood explanations of insurance products and services. We pride ourselves on our practical experience and ability to provide full-service to help people develop and implement their insurance plans.

We look forward to using our expertise to help you pursue your insurance plan!

Legacy & Estate Planning:

After a life long journey of hard earned wealth and achievements, the process of bequeathing one’s assets to the future generations while simultaneously channeling resources to one’s special agenda e.g. philanthropy, is broadly defined as the process of legacy planning.

While creating a will is a necessity for each and all, Legacy and estate planning is most relevant for small business owners who might have assets and investments in their business’ balance sheet. While estate planning deals with transfer of tangible assets in event of disability or death, legacy planning involves adding a purpose to estate planning like family beneficiaries or philanthropic goals.

We help in clients living life on their own terms with the whole lifecycle in perspective while doing investment planning. Structuring a long-lasting inheritance for loved ones requires expertise and coordination between investment, legal and tax domains.

We help you to ensure a smooth transition of wealth from one generation to the next. From organizing lifetime gifts, identifying and implementing the right succession planning vehicle drafting and implementing wills, we ensure that your wealth is structured around your objectives, values, constraints and special considerations when passing it on.

Whether it is something straightforward like creating a will to something more complex like creating a trust, we help clients to focus on their goals in terms of wealth investment, wealth preservation, wealth distribution or wealth transfer. We help create a bullet-proof will which will not get entangled in legal complications when you need to execute it the most.