S And P 500 Investments

Falconstar Investments

Apr 5, 2021·4 min read

S&P 500 Investments

Positioning for Markets in the next 12 months :

Stagflation Risk & Bull-Bear Scenarios

Dear Investors,

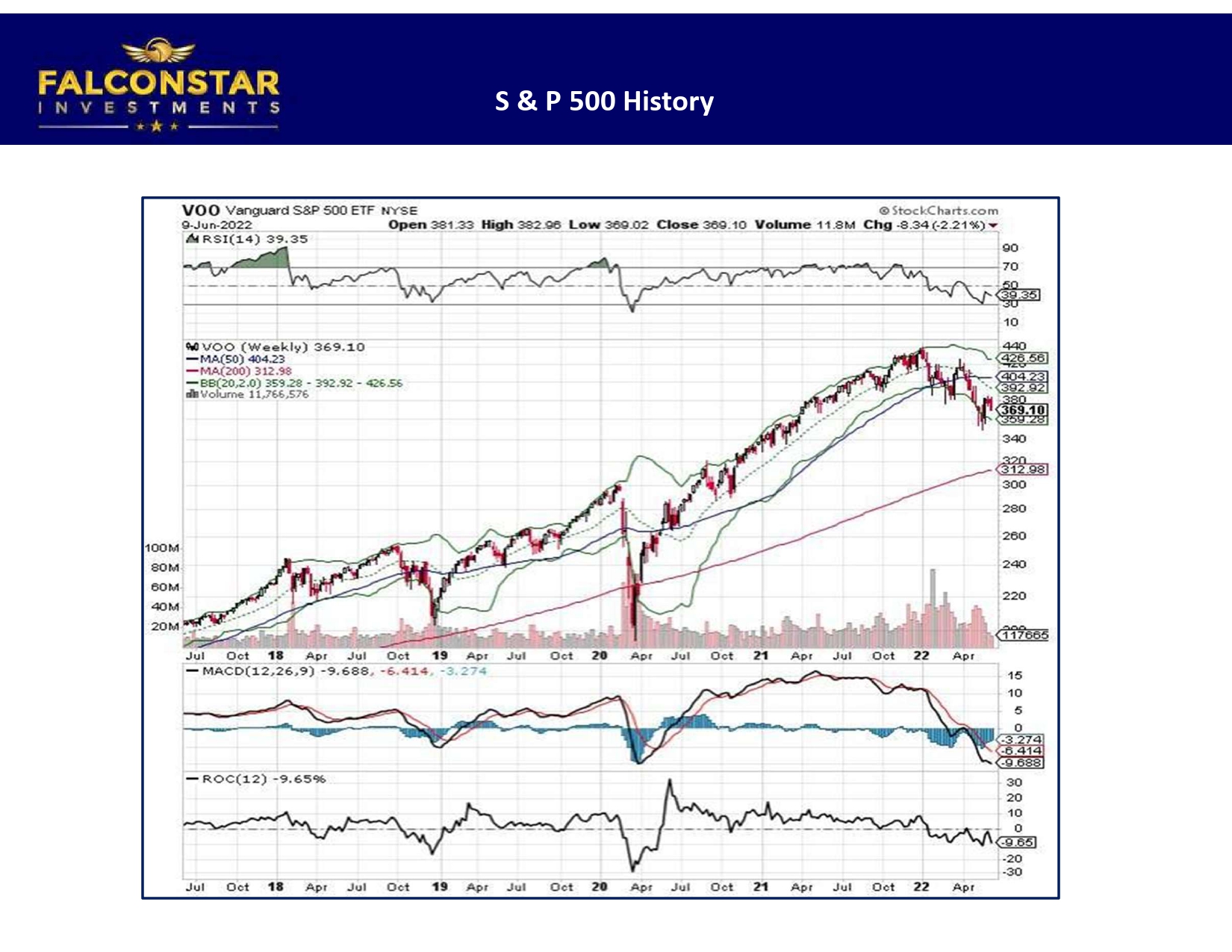

With YTD returns of Nasdaq (-25.7%), S&P 500 ( -16.2)% & NIFTY50 (-8.06%) - what has played out in 2022 is the Russia-West geopolitical crisis, rising crude prices (+60%) and Steepening Yield Curve with 10-year Indian G-sec (+75 bps ).

With heightened Inflation risk being highlighted in every Economic forum and Fed / RBI expected to raise another 80-100 bps in 2022, FIIs selling their 20% holdings in IndiaInc# the question is what should the Investors do at this juncture ?

Bullish Case : In case this current geopolitical tension and supply chain issues dont escalate, then we can expect that even with 100 bps rate hike in next 12 months, Markets could end up higher on back of historic low Interest rates. For example, Nasdaq at 16000 or NIFTY at 19000.

Bearish Case: On the other hand, as per our experience in 2001 and 2008, a back-breaking event like 9/11 or Lehman can completely dismantle the weak Markets. It is difficult to predict such Black-swan events, but looks like Markets could even break 200 week Moving Averages if such an event happens. NIFTY50 could reach 12K or Nasdaq could fall to sub-10K levels. If Inflation persists and Growth stumbles then there is a Stagflation Risk followed thru with mild recessionary symptoms.

Investor Type #1 Scenario : For the Individual Investor who has liquidity to continue their SIPs for next 3 years on staggered basis should stick to their plan & should infact pray that Markets correct so that they can Buy at better prices from a 5 year perspective. If Sensex falls to 43-45K in next 12 months, it might as well be in the 80-90K range in 5 years time.

Investor Type# 2 Scenario: For the Seasoned Investor who wants to take double advantage of Market correction and who has Liquidity to deploy, they might as well continue their SIPs but double up during down months over next 12 months.

Investor Type #3 Scenario: The difficult part is to keep SIPs running and chasing the Markets on the upswing. Although this looks good optically on Investor Portfolios while Investing through the up cycle, it is actually not profitable in the 5 year horizon because it will reduce CAGR%. For the Tech savvy Active Investor with Online access and who believes in being opportunistic, it is better to do lumpsum investment only on days when Markets correct > 2%.

Pls contact Falconstar Investments for a discussion or feedback based on Investor Type 1, 2, 3 self-assessment so we can contribute meaningfully to your continued wealth creation, financial goal planning and execution.